At the Hasley Homes, we all know the importance of obvious and you can direct pointers in the event it pertains to homeownership. Contributed by Jake Meottel, a beneficial United states Armed forces Veteran that have thorough experience in a residential property paying, the relationship should be to foster faith and supply valuable skills to own the area. One area in which we often come across misunderstandings is with Va household funds. Let us put this new listing straight and provide you with the main points you need.

Va Home loan Mythology Debunked:

Navigating the field of Va home loans is challenging, especially because of so many mythology and you will misconceptions distributing. Let’s address several of the most common mythology to greatest understand the masters and you can facts out of Va loans.

Misconception step 1: You could potentially Just use an excellent Virtual assistant Financing Immediately after

Not the case. Probably one of the most preferred mythology is that Va fund can also be simply be put after. Actually, you should use a great Va loan several times. As well, you can have multiple Virtual assistant loan unlock within once. When you yourself have paid down a past Virtual assistant mortgage or if perhaps your sell a home ordered with good Va financing, you can heal the entitlement and employ it again for the next home.

Misconception dos: You desire Perfect Borrowing

Not true. Yet another widespread misconception is the fact a perfect credit score is necessary to own a beneficial Va loan. New Va alone does not lay a minimum credit score criteria. Even though many lenders choose a get with a minimum of 620, it isn’t a hard and fast laws. The fresh new VA’s independence was created to help far more experts be eligible for lenders, even if their borrowing from the bank isn’t really clean.

Misconception step 3: Virtual assistant Fund Dont Romantic Very often

Not the case. Virtual assistant money provides a track record to be hard to personal, however, this is simply not perfect. In reality, Va finance keeps a higher closure price as compared to antique and FHA loans. Brand new VA’s guarantee brings lenders with additional protection, making it easier to allow them to agree and you can procedure these financing.

Myth 4: Virtual assistant Financing Have Unanticipated Out-of-Pouch Costs

Incorrect. Many believe that Va funds incorporate invisible costs, but that isn’t genuine. Virtual assistant financing will feature no private home loan insurance coverage (PMI) and require zero downpayment, which will help eradicate out-of-wallet costs. The expenses of this Virtual assistant financing are easy and you will transparent.

Myth 5: Virtual assistant Finance Features A lot of Government Red-tape

Incorrect. Whenever you are Va finance are supported by the federal government, they won’t have way too much red tape. Extremely Va funds try underwritten instantly, skipping the need for extensive authorities approval. It sleek process support expedite mortgage approval and closing.

More information on Va Home loans

Navigating Va mortgage brokers can seem to be complex, but knowing the requirements and you will process can make it convenient. Here, we falter the necessities in order to on your travels to homeownership.

Can i Score Virtual assistant Loan to own the next Household?

You happen to be able to repair your Va entitlement to make use of for buying an alternate domestic, provided specific conditions try met. This is certainly instance helpful while you are relocating otherwise buying good next house getting financial support objectives.

Do you know the Requirements to own Va Financial?

Locate good Virtual assistant mortgage, you want a certificate from Qualification (COE). That it certificate shows your qualifications based on provider requirements. If you don’t meet the minimum solution requirements, there is certainly option a way to qualify, particularly because of launch grounds and other special items.

What’s the Virtual assistant Mortgage Processes?

The procedure to demand a great COE involves implementing on the internet otherwise courtesy their financial. Otherwise meet the simple services conditions, you may still qualify considering unique facts or a discharge enhance.

Do you really Tell me A lot more about Virtual assistant Financial Qualification?

Qualification to own a good Va financial utilizes service records and you may duty position. Including veterans, energetic obligation provider people, reservists, federal shield participants, thriving spouses, and you may specific U.S. citizens whom supported while in the WWII. Personal Wellness Service officers, cadets from the service academies, and you will officials of your own National Oceanic and Atmospheric Government plus meet the requirements.

Does Va mortgage foreclosure forgiveness occur?

As the Virtual assistant cannot render outright foreclosure forgiveness, it will give guidelines software to assist experts stop foreclosure. The fresh VA’s Financial Program comes with options such as for instance loan modification, cost agreements, and you may forbearance to simply help home owners who will be troubled. At the same time, the fresh Va will assist that have refinancing choices to build money significantly more in check and manage loan providers to find ways to prevent foreclosure.

Do you know the credit score standards for good Virtual assistant home loan?

The newest Virtual assistant by itself will not put a minimum credit rating requirement to own Virtual assistant mortgage brokers. However, really lenders features their own credit history conditions. Generally speaking, loan providers discover a credit score of around 620 or more. It is vital to consult individual lenders for their certain criteria, because they can vary.

Exactly what are the benefits associated with good Virtual assistant mortgage?

- No Downpayment: Va loans usually need no down-payment, and work out homeownership even more accessible.

- Zero Personal Home loan Insurance coverage (PMI): In place of traditional financing, Virtual assistant financing none of them PMI, reducing monthly payments.

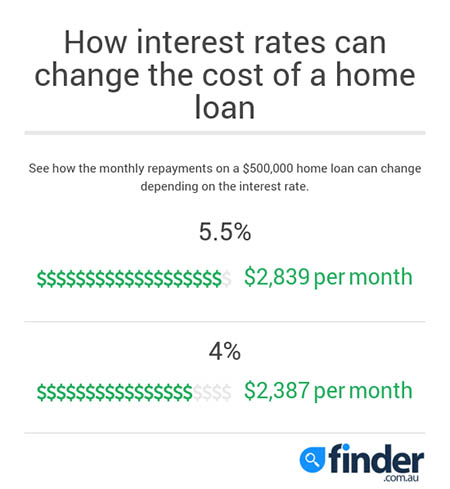

- Aggressive Rates of interest: Virtual assistant money always feature straight down rates of interest compared to the traditional fund.

- Flexible Borrowing from the bank Criteria: Virtual assistant fund provide even more flexible credit history standards, providing a lot more veterans meet the requirements.

- Recommendations Programs: The latest Va provides info and assistance for those who deal with financial troubles, assisting to stop foreclosure and you can do money.

Who is eligible for an excellent Virtual assistant mortgage?

Eligibility for a Virtual assistant mortgage utilizes services history and responsibility status. For example pros, active obligations solution participants, reservists, federal guard users, surviving spouses, and you may certain U.S. residents who supported during the WWII. Social Health Service officers, cadets in the services academies, and you will officers of your National Oceanic and Atmospheric Management including qualify.

Why Hasley Land Cares (As well as how We can Help)

In the Hasley Homes, added of the Jake Meottel, we have been intent on support the area and you may providing credible actual home choices. Our very own dedication to cultivating trust and you may managing the consumer relating try rooted in Jake’s detailed experience and military history. We all know exclusive pressures experts face and are generally here in order to make suggestions from the Virtual assistant financial techniques which have visibility and you will empathy.

Regardless if you are examining the choices getting a Virtual assistant mortgage, need assistance that have repairing your own entitlement, or are just seeking https://paydayloanalabama.com/bon-secour/ advice on the home to acquire procedure, Hasley Belongings is here now to assist. Our very own objective should be to make sure you feel the recommendations and assistance you should create informed s.When you yourself have questions otherwise you need after that direction, don’t hesitate to reach. Our company is right here to offer the suggestions and support you are entitled to.

Comentaris recents