From this article

Building a property can be a complex techniques specially when it concerns investment they. A great USDA construction mortgage was created to describe this course of action by the taking that which you to one another less than one loan. That it no-off, low-notice mortgage is a wonderful selection for lowest-to-moderate-income people trying to create a home when you look at the an outlying city.

??Just what are USDA Design Financing?/h2>

USDA construction-to-permanent money, or USDA construction loans having short, is a variety of that-date close home loan guaranteed from the You.S. Service out-of Agriculture (USDA). Such financing are part of the new USDA’s Unmarried Family members Houses Guaranteed Mortgage system, and therefore is designed to build homeownership a whole lot more available getting outlying, low- or modest-income homeowners.

Whilst greater part of money given within the system try to own present unmarried-house instructions, the brand new USDA construction financing is unique since it allows the consumer to finance the purchase of property plus the cost of creating a special household involved. In lieu of many other framework loans, and therefore require one mortgage getting structure plus one for choosing the residential property, all things in a beneficial USDA structure mortgage is actually below that umbrella that have you to definitely closing.

As they are guaranteed of the USDA, this type of finance give nice words – usually as well as zero down-payment requirements. That renders them an effective option for particular outlying homebuyers. The fresh disadvantage is that you can find few USDA framework loan loan providers in the market at this time.

USDA Design Financing Criteria

Conditions to have USDA construction funds are like those individuals some other USDA financing designs. The complete family money try not to exceed the newest USDA earnings limitations to possess where you are. This type of fundamentally start at the $110,650 for a family group all the way to four, even so they tends to be highest according to an area’s price of lifestyle.

Although the USDA has no its own minimum credit history requirement, some loan providers get a hold of a get of at least 640. Most other loan providers, eg Natives Financial, can go as low as 620, so it may help to comparison shop when your credit history is a concern. You’ll also normally need an obligations-to-earnings proportion during the or lower than 41%. The total amount you spend for the homes, as well as property fees, insurance and you will homeowner’s relationship costs, can’t be more than 34% of your money.

Property Criteria to own USDA Finance

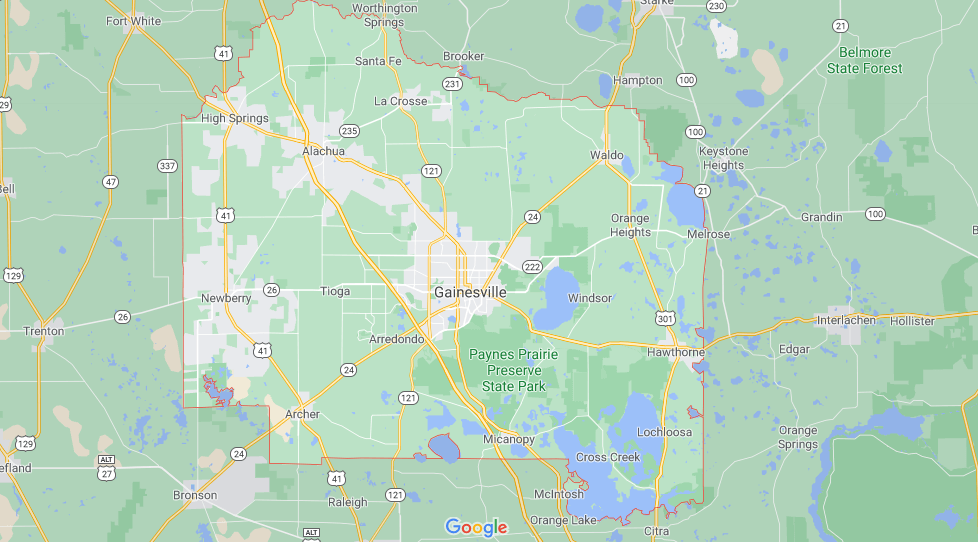

USDA financing likewise incorporate even more property limits than conventional fund. As the USDA strengthening finance was geared towards helping homeowners when you look at the outlying parts, the construction project will have to slide in one of the USDA’s designated rural parts. On top of that, our home must be the majority of your house.

The fresh new USDA also states you to definitely people construction your finance that have one to of its financing need certainly to match the room. So it generally function the home dont surpass dos,000 sq ft, however, specific exclusions can get use.

Specialist Standards to have USDA Money

Good USDA brand new design financing is served by particular conditions on designers involved in the project. Any developers should be passed by the bank, enjoys no less than couple of years of expertise that have solitary-home construction and get fully registered to the work. They need to likewise have a strong credit rating, clean records have a look at and you will the least $500,000 during the responsibility insurance policies.

How do USDA Single-Intimate Build Fund Work?

One of the primary benefits of an excellent installment loans Sumter SC USDA structure-to-long lasting financing is that its one-personal mortgage. With lots of the-house design tactics, you will need to glance at the financing process double – after on structure financing and once to refinance one to for the a basic financial buying the very last property.

That have a beneficial USDA construction financing, you only need to make an application for one loan and experience the entire techniques immediately following. You can only pay one set of closing costs, and when it’s all said and you will done, you can walk off which have a good USDA-backed 30-12 months home loan in your new home. In the process, you can utilize the loan to pay for some build-relevant costs, about first land pick in order to permitting, construction and you will landscaping charge.

The fresh new downside from USDA loans would be the fact these include a lot more restrictive than just old-fashioned mortgages. For that reason, of numerous buyers try not to fit the latest rigid income constraints and area criteria needed seriously to be eligible for a great USDA the fresh new construction financing. In addition, it are hard to find a loan provider that provides this mortgage.

The way to get an excellent USDA Design Mortgage

To start with, before you could rating past an acceptable limit in the act, you’ll need to locate an effective USDA-acknowledged contractor including a loan provider that may funds a beneficial USDA build mortgage.

Once you’ve discover each of those people, you can go after a similar way to what you should for those who was indeed applying for a fundamental USDA financing:

If you meet with the earliest USDA build loan conditions, it’s not too difficult to help you qualify for these types of unmarried-personal mortgages. Finding a loan provider and you can approved specialist may be the hardest boxes so you can take a look at, thus after you have complete those individuals, you may be well on your way.

Without downpayment criteria and you will a smooth transition regarding an effective build financing so you can a long-term financing, a great USDA framework mortgage is a fantastic answer to financing their dream family – and to build it just how you dreamed.

Comentaris recents