Money and Costs

Your income and you will costs gets an effect on how much you can use. A good history of work and a reputation normal deals on your family savings will make it easier for you locate home financing. Lenders want to see evidence of good economic management, to ensure they aren’t getting too many dangers. This can be done that with another savings account with increased interest rate and also make normal dumps and you can restricted withdrawals. *

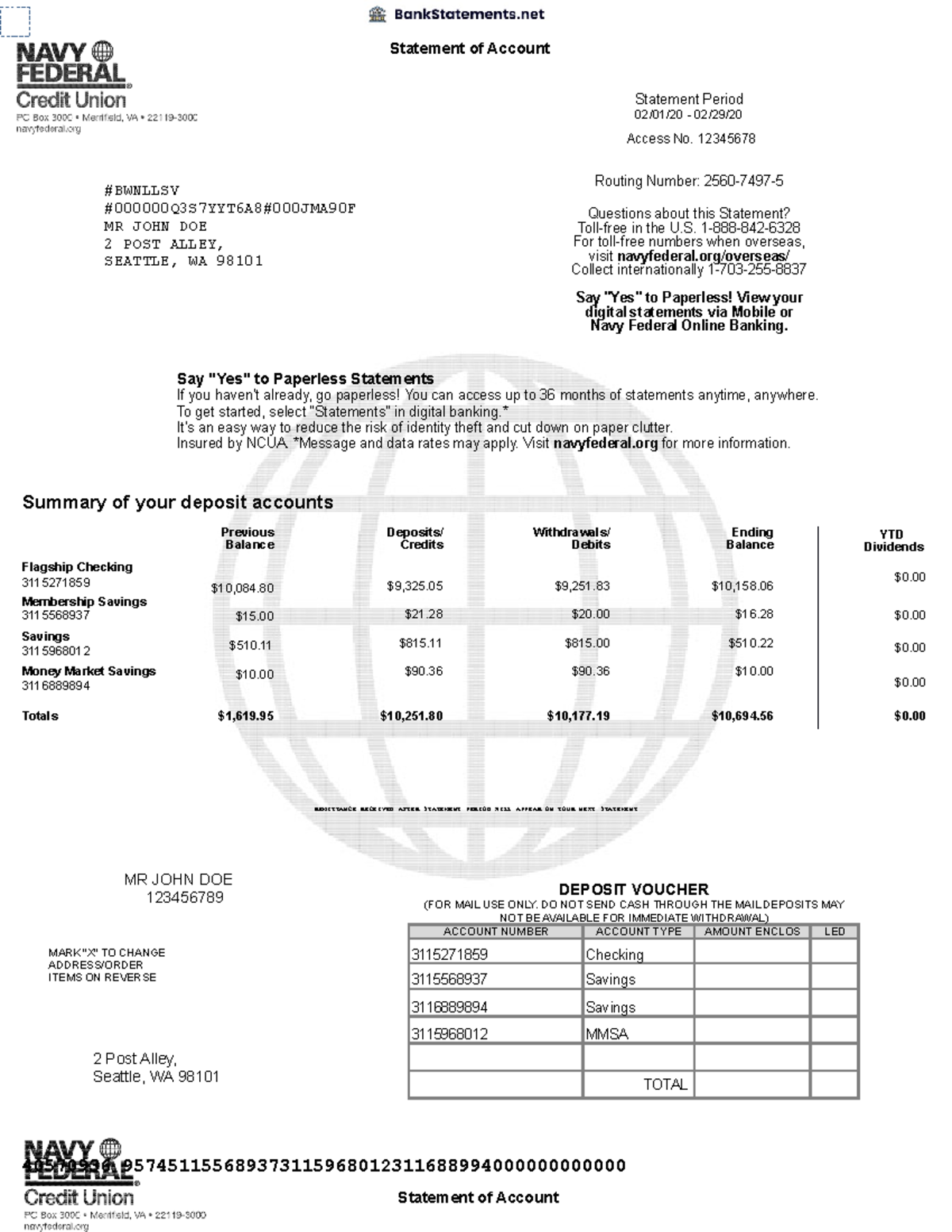

Loan providers will take into consideration any money you really have and the fresh new payments in the these types of financing. As well as that it, lenders will normally glance at lender comments the past around three so you’re able to half a year whenever assessing a software. It means it is very important keep the family savings manageable, ensure there aren’t any late costs and therefore your bank account does not score overdrawn.

Credit rating

Very lenders perform a credit report have a look at within a credit card applicatoin. The main points on the credit history file can indicate the difference ranging from having that loan recognized or perhaps not. Your credit history tend to record any occasions in which you features used having borrowing from the bank, the outcomes of those software and one credit default suggestions entered because of the a 3rd party. You can examine your credit history through credit agencies such as Equifax Pty Ltd (equifax.au).

2. Their home loan repayments

By playing around having calculators, it is possible to thought how much youre safe spending per times from inside the home loan repayments. Think of, you should not only build your mortgage payments easily for each day, however, so you’re able to also have enough money getting problems or unexpected costs.

Our home financing payment calculator can help you estimate the actual rates of your buy. It entails into consideration expenditures anybody usually ignore when selecting a property such as stamp responsibility, rates, insurance policies, repair and a lot more.

3. What sort of assets we want to get

The type of assets considering to acquire will have an effect on the quantity you could acquire. A lender usually takes into consideration the worth of the property. A valuation accomplished on behalf of a lender takes with the account the worth of the home across the long term, plus people most recent manner in the industry. Loan providers make use of the property so you can secure the financing, it is therefore essential they are able to promote the property to recuperate one costs, should you be struggling to pay mortgage repayments.

If you are searching from the purchasing an investment property in order to lease, the financial institution will likely take into account the number of book you would loans in Shaw Heights expect to receive towards the possessions included in the entire application for the loan process.

4. The application

After your day, how much you could potentially obtain is guided by the financial. Lenders and you can financial institutions provides a task to inquire of concerns in order to make sure the amount you borrow caters to the money you owe which you are able to result in the needed repayments each month. Your lender might look at your credit report and borrowing record.

Communicate with a loan provider to discuss your role in order to look for away simply how much you could potentially obtain. By the talking-to a lender you’ll find out just what it will need from you to possess a loan application, and they’re going to have the ability to read different kinds of money, prices and mortgage numbers and you can explore the way they apply at mortgage repayments.

2nd strategies

When you need to rating a calculated estimate of your home mortgage credit electricity, you can use our very own on the web mortgage borrowing from the bank bower calculator.

Think of, we offer pre-recognition towards mortgage brokers in order to go shopping for a property with additional trust. So you’re able to arrange a home loan pre-acceptance ask on line, phone call 13 fourteen twenty two or miss into your nearest branch and you may talk to one of the credit specialists.

Comentaris recents