Happens to be a great time? | How to purchase one minute domestic | Ought i live in my personal money spent?

More than one or two million Aussies individual the next assets step one . Whether you’re keen to grow your a home portfolio otherwise dreaming off a holiday home, here are a few considerations up to to acquire another family.

There might be many intentions to find a second family, one or two prominent causes was just like the a financial investment, and for life. The initial ones relates to fairly mental choices: selecting the most appropriate area within proper rates, and getting leasing earnings therefore the possibility of funding development in the long run. However if you’re interested in to invest in a vacation family, a city pad having works, otherwise a single-day-we’ll-retire-right here family, it is not usually towards wide variety.

Is actually a good time to look at purchasing the next home?

Just how really does equity performs when selecting an additional household? Really, for people who already own the house you live in, you will be able to use the fresh new guarantee you’ve gathered to acquire a moment home otherwise money spent. Meaning you don’t have to save an alternate put to buy your 2nd domestic.

To purchase a secondary house

The idea of managing your own spot out of comfort near this new coastline otherwise plant will be enticing. You have the freedom of a familiar vacation spot to utilize once you instance and tell relatives and buddies.

not, if you’re planning to pay for no less than a number of the costs out of possessing a vacation house with normal holiday rentals, it can be a good idea to very first sound right every the costs inside it.

When Sara and you can Jason ordered an additional domestic a few hours north of Sydney, these were sold on the opportunity to split their go out here with Airbnb accommodations. However, despite our house kepted continuously to have 10 weeks good season, the costs much exceed the income. And focus to your home loan, you’ll find all the expenditures from powering it as a holiday rental out of property management, cleanup and you will linen provider down seriously to brand new hair care and you may coffee pods.

Yet not, they find their next home as the an extended-name money inside the existence, as opposed to an income generator having today. Capable really works after that, express the area with regards to high school students and you will relatives, and something date intend to retire around.

Investing a family retreat

When you have adult students still-living home, or more mature parents enduring ascending lease costs, you could get a residential property and become its landlord.

It can be best if you believe an area you to ticks best packets to possess a general list of upcoming tenants near to transportation, schools and you will a job, particularly. To learn more understand the real-lives guide to to purchase an investment property.

To get a work-created house

More 70,000 Australians gone to live in local components dos for the pandemic. While one of them and today need certainly to operate in the metropolis once again a short time weekly or if performs today needs you to travel road on a regular basis it can be a selection for one to purchase one minute domestic close your workplace.

Believe now for upcoming senior years

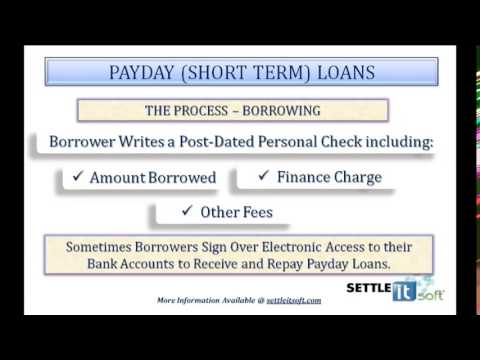

You might also check out to buy the next household on your fantasy senior years place and you may lease they in order to an extended-title tenant until you payday loans Sheffield may be happy to move around in.

A few of these second home choice would-be treated since a financial investment getting taxation objectives. Which means you can counterbalance people costs involved in managing the fresh assets including your home loan interest against your own nonexempt money. This is certainly titled bad gearing.

Comentaris recents