The fresh pre-foreclosures stage is actually stage one of court legal proceeding in the regard to a difficult assets. If your home is on the foreclosure procedure, you will find a premier possibilities it can sooner get repossessed by financial or mortgager. It notice records the borrower’s package conditions, allows them understand they might be from inside the standard getting low-fee, which the bank has begun brand new court procedure to your foreclosures. This really is probably the main phase from the foreclosures techniques. Lenders commonly in the industry off evicting individuals from their houses when they won’t need to. In some cases, the lender will work to the resident to help you contrary their default position. You can do this by creating right up overlooked repayments, requesting an amendment, otherwise deciding to promote our home earlier changes to the complete-blown foreclosure.

#1) Begin looking

Among most difficult parts to possess pre-property foreclosure homebuyers is actually selecting a property. Since assets in this phase isnt but really theoretically for sale payday loans South Coventry without checking account, its perhaps not placed in the fresh new Mls. Thus, searching ProspectNow’s constantly updated off-markets posts to begin with. You may lookup public information otherwise flip towards the back from a district newsprint where foreclosures observes are usually noted. Whenever you are a real estate agent or agent wanting pre-foreclosure, consider upload on line, carrying out an email venture, otherwise starting flyers in your community letting anyone understand you are curious.

#2) Go search

Once you have receive an excellent pre foreclosures assets, go see. You can scope the actual community and then have an end up being getting this new home’s position. You could affect catch the proprietor additional and struck right up a conversation. Contemplate, while the owner most likely nevertheless lives right here and could not be on the market to market the house, end up being judicious. They may or may possibly not be motivated to sell.

#3) Sit current

Oftentimes, owners to your verge out of standard wind up fixing the financial products. It’s a good idea to remain upgraded toward condition away from a house. You can aquire in touch with the property’s trustee. A property foreclosure trustee is in charge of filing the latest papers that initiates a foreclosure, very they will constantly understand the position of the features they might be responsible having.

#4) Know the finances

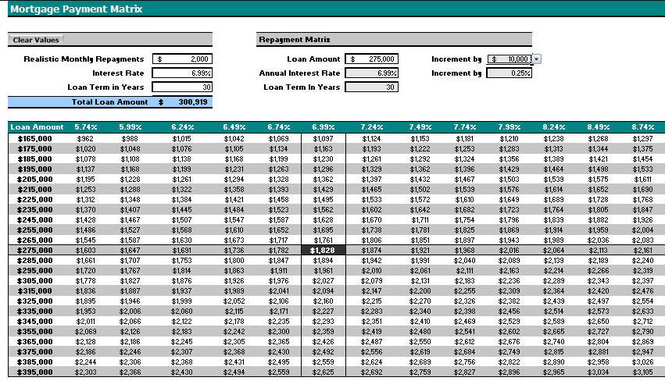

Homes when you look at the property foreclosure tend to only require the fresh delinquent total conclude the purchase, with other typical charge, such as name import and other closing costs. Because you search house within the pre-foreclosure, verify the borrowed funds harmony, potential liens, and just about every other fines that will was basically assessed. Get in touch with an enthusiastic appraiser in the area to ascertain the brand new house’s estimated really worth. Then you will perform some mathematics seem sensible the expenses from a lot more than and you will subtract all of them in the estimate. From that point, you could potentially regulate how much you may be ready to put in a beneficial pre-foreclosure pick.

#5) Get in touch

Now that you have make the homework, now is the time to-arrive over to the owner. A letter otherwise name (perhaps not email address, because the that may be noticed too unpassioned because of it types of sale) is the perfect means to fix tell you the particular owner you are curious. Bear in mind, in these instances, it has been just the house that is disappointed. Up against the potential for shedding a property is out of exhausting, very large amounts of tact are essential. According to the temperatures of proverbial drinking water, inquire if you possibly could trip the house as well as assets. This lets you put a few more amounts for the more than step in case of any fixes. Whatever the, its important to will always be courteous and you will careful all of the time.

Comentaris recents