Creditworthiness

While the USDA cannot place the absolute minimum credit rating criteria , extremely lenders favor a get out of 640 or even more. Good credit rating shows your capability to handle debt responsibly, which is a button grounds to own loan providers in relation to your loan software.

Notice : A credit history is basically a mathematical icon of one’s creditworthiness centered on your borrowing record, fees models, and outstanding bills.

Lenders have fun with credit ratings to evaluate the possibility of credit your money. A high credit rating ways a reduced chance into bank, since it ways a strong reputation controlling debt loans.

Should your installment loans Bolton Ohio credit score drops underneath the 640 mark, there are steps you can take to change the probability away from being qualified getting a good USDA Loan. Below are a few recommendations:

- Get a duplicate of the credit file and you can feedback they cautiously . Come across any problems or discrepancies that might be turning down the rating. You might disagreement people mistakes you notice towards credit reporting agencies.

- Build a propose to pay down loans . Cutting your credit usage ratio (the level of borrowing you employ as compared to their complete credit limit) can also be somewhat improve your rating.

- Build consistent and on-day payments to your all of your current expenses . Commission record is one of the most extreme facts affecting your credit history.

- Thought making an application for a good USDA Financing having a beneficial co-signer . A beneficial co-signer was individuals that have an effective credit rating who believes in order to be responsible for the loan for people who default. Which have good co-signer can help improve your application and change your possibility of approval.

Debt-to-Money Proportion (DTI)

Your debt-to-income proportion is the part of your terrible month-to-month money you to would go to financial obligation money. For USDA Financing, your DTI would be to essentially maybe not meet or exceed 41%. It indicates their overall month-to-month costs, including your future mortgage repayment, would be below 41% of your pre-tax money.

Citizenship/Residence

- United states Resident : If you find yourself good Us citizen, your automatically see that it requirement.

- United states Non-Resident National : This status applies to individuals produced in certain You regions, eg Western Samoa.

- Qualified Alien : These kinds is sold with lawful permanent customers (green cards proprietors), asylees, refugees, and other low-citizens with particular immigration statuses. You will need to render files to show your own accredited alien position.

- Good Public Safeguards Amount : Irrespective of their citizenship otherwise home condition, you really need to have a legitimate Personal Safety amount so you’re able to be eligible for a great USDA Financing.

That it requisite assurances USDA Financing apps was offered to those individuals legitimately signed up to live on and you can work with the us.

Now that there is shielded the borrower criteria let’s look into the USDA home loan home criteria. Not every house is entitled to a good USDA Financing, very understanding these conditions is essential of your home look.

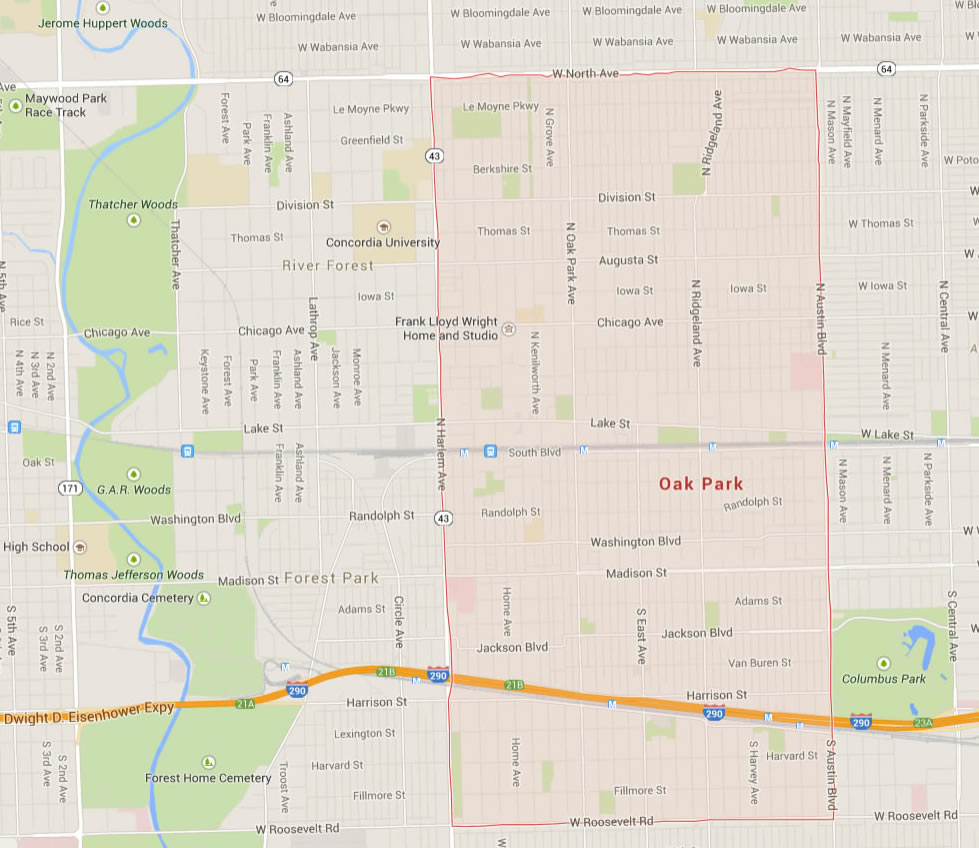

Location: USDA Financial Home Standards

Remember the USDA eligibility map i chatted about before? The house we should get have to be discover in this good USDA-appointed outlying city. While this might sound limiting, brand new USDA’s concept of rural is surprisingly large, close of several elements you might not generally think. To verify your ideal home’s qualification, utilize the interactive qualifications map or consult a loan Officer. Capable rapidly make certain in the event your property fits the region criteria.

Primary House

USDA Loans are exclusively for number one residences, meaning the house you get have to be most of your dwelling, perhaps not a vacation home otherwise a residential property . You should want to occupy the home as your dominant household to have a significant part of the season. It requirement assures USDA Funds are acclimatized to offer homeownership for some one and you may group, perhaps not to have industrial aim.

Comentaris recents