Step one: Find out how Far You could Acquire

When it comes to to purchase property, you really need to decide how much domestic you really can afford even before you start lookin. Of the reacting several simple concerns, we are going to estimate the to get energy, predicated on simple financial direction.

You may want to elect to score pre-acknowledged for a loan and therefore means verification of income, borrowing from the bank, property and you will obligations. We recommend that you earn pre-accepted first searching for your brand-new family and that means you can:

- See functions within your assortment.

- Get into a better reputation whenever settling into seller (supplier knows your loan has already been acknowledged).

- Romantic your loan smaller.

LTV and you may Loans-to-Income Percentages LTV or Loan-To-Really worth ratio ‘s the limit level of exposure you to definitely a lender was ready to deal with in funding your purchase. Loan providers usually are ready to give loan place in West Jefferson a higher portion of new well worth, even up in order to 100%, so you can creditworthy individuals. Yet another thought in granting as much mortgage for an effective kind of debtor ‘s the proportion away from monthly obligations repayments (including automobile and private fund) so you’re able to income. Thus, individuals with high loans-to-income proportion have to pay increased down-payment in check so you’re able to be eligible for less LTV ratio.

From the Smart-money The state we all know that everyone doesn’t have an equivalent financial wants. We ensure that we take care to find out what your own lasting needs come into first with the intention that we are able to tailor each package to reach your individual wants. I dump each of our clients such as for instance we might all of our loved ones and you may family unit members this is why readers arrive at united states because of their future requests otherwise refinances time and again. Why don’t we convince your why Smart money Hawaii keeps various of 5 superstar evaluations online!

FICO Credit score FICO Credit scores was popular from the most form of lenders within their credit choice. It is a beneficial quantified way of measuring creditworthiness of individuals, that’s based on mathematical models developed by Reasonable Isaac and Team when you look at the San Rafael, Ca. Its centered on enough activities plus earlier payment history, total level of credit, amount of credit score, choose the brand new borrowing, and type regarding borrowing built.

A number of all of our clients will come to help you united states which have a card score as well reasonable to help you be eligible for home financing. Its facts similar to this where Smart-money Hawaii’s finest-level services stands out comprehensive. When it possess took place to you personally, we can help by providing suggestions on ideas on how to improve your fico scores so you’re able to qualify. We likewise have detailed expertise in the many financing versions offered to those with all the way down fico scores. Make use of our very own no-cost properties today!

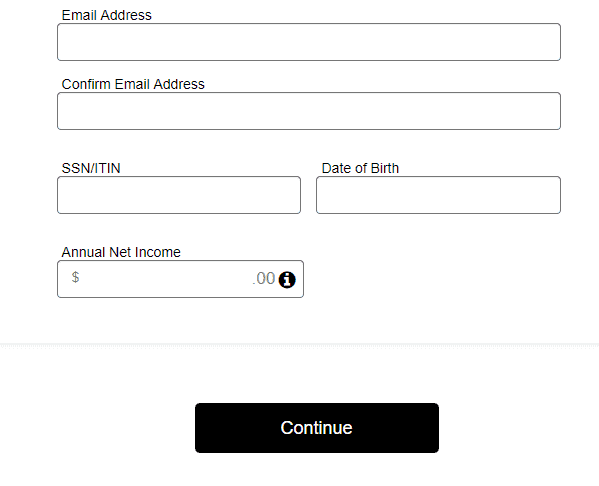

Financing Procedure

One-man shop Borrowers Self-employed some one usually see there exists better hurdles so you can borrowing from the bank to them than simply an applied person. For some conventional loan providers the situation with lending towards thinking functioning body is documenting an applicant’s money. People which have efforts also have loan providers with spend stubs, and you can lenders is guarantee the information by way of its manager. In the lack of such as verifiable a position facts, lenders believe in tax efficiency, which they normally wanted for a couple of many years.

If you are one-man shop, don’t get worried! I work on all of our clients directly to conquer people obstacles you to arise as well as have effectively aided tens and thousands of one-man shop consumers fund the place to find its dreams.

Way to obtain Deposit Lenders expect consumers to bring about adequate cash with the down-payment and other fees payable by the brand new debtor at the time of investment the borrowed funds. Generally, advance payment criteria are built which have financing the latest individuals enjoys protected. Documentation appearing brand new debtor has experienced the income over the past 2 months are needed to satisfy anti-currency laundering guidelines. In the event that a borrower doesn’t always have the required deposit it can get located provide funds away from an acceptable donor with a finalized page stating that new skilled funds don’t need to be paid straight back.

Comentaris recents